Bitcoin halvings have long been a celebrated event in the crypto space, often associated with the anticipation of massive price surges. But what happens when, instead of skyrocketing, Bitcoin’s price seems to stagnate or even decline after a halving? As an experienced crypto investor, I’ve seen firsthand how these market dynamics play out. In this article, I’ll delve into why Bitcoin sometimes goes down after halving, offering insights drawn from years of investing experience and market analysis.

What is Bitcoin Halving?

Before we dive into the reasons for post-halving price declines, it’s essential to understand what Bitcoin halving is and why it’s so crucial to the market.

Bitcoin halving refers to the event where the reward for mining new Bitcoin blocks is cut in half, which occurs approximately every four years. This mechanism is embedded into Bitcoin’s code to control inflation, reduce the rate at which new Bitcoins are created, and ultimately cap the supply at 21 million.

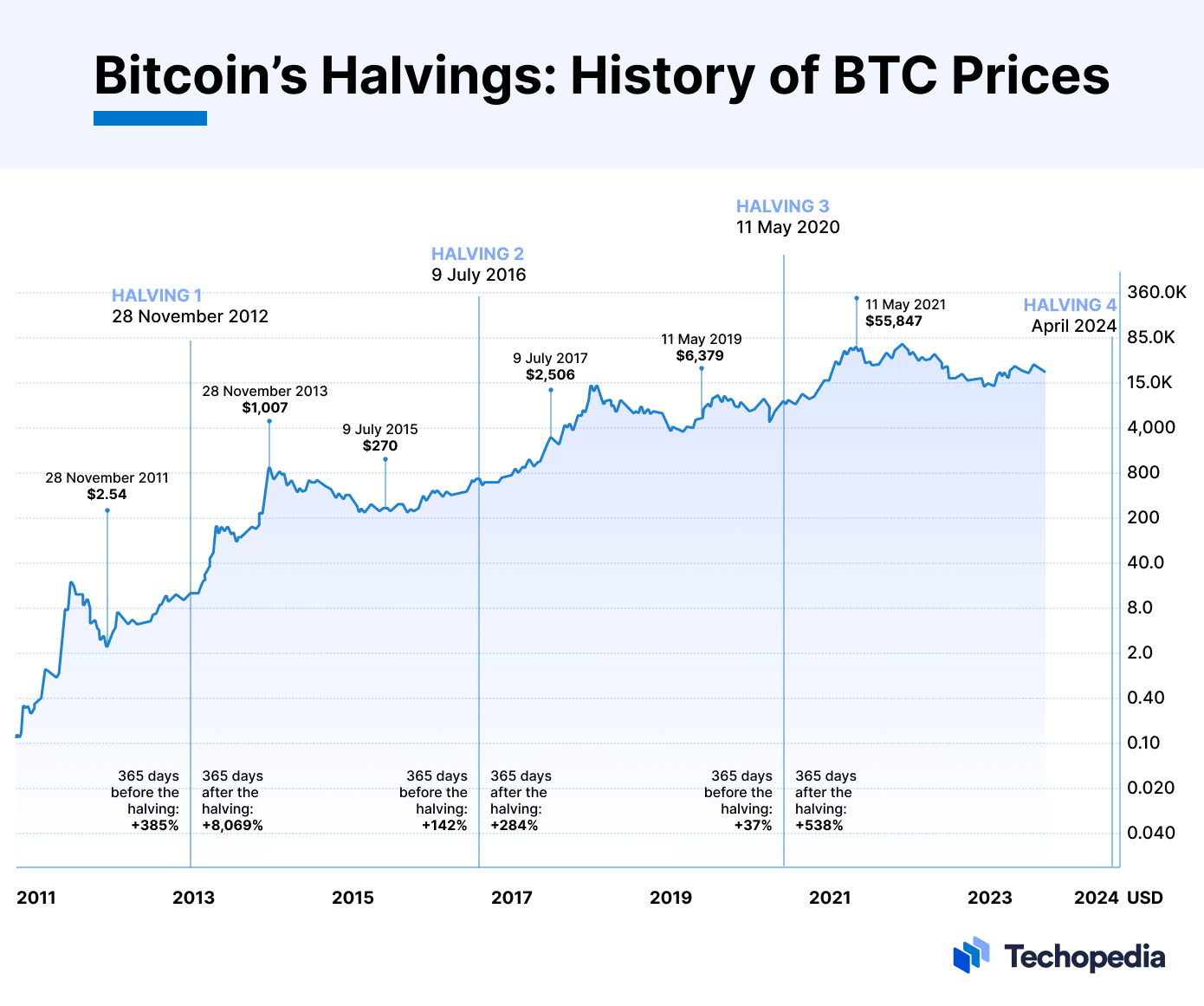

To date, Bitcoin has undergone three halving events—in 2012, 2016, and 2020—with a fourth expected in 2024. Each halving has historically been followed by a significant bull run, leading to new all-time highs. However, the periods immediately following these events have not always been smooth sailing, with some marked by corrections and prolonged consolidation.

The Hype and Reality of Post-Halving Price Movements

The Hype: Expectations vs. Reality

The hype surrounding Bitcoin halvings often leads to a “buy the rumor, sell the news” scenario. Many retail investors enter the market with expectations of immediate gains, driven by the belief that reduced supply will instantly lead to higher prices. However, the reality is often more complex.

The Selloff: Profiting from the Hype

Experienced traders and large holders (often called “whales”) may take advantage of the hype to sell off their holdings, knowing that retail investors are likely to buy in anticipation of a price surge. This selloff can lead to a temporary decline in Bitcoin’s price post-halving, as the market absorbs the selling pressure.

The Role of Market Sentiment

Fear, Uncertainty, and Doubt (FUD)

Market sentiment plays a crucial role in Bitcoin’s price action. Post-halving, if the price does not immediately surge as expected, fear, uncertainty, and doubt (FUD) can spread among investors. This can lead to panic selling, further driving the price down.

The Impact of Media and Influencers

The media and influential figures in the crypto space can exacerbate FUD. Negative news stories, bearish predictions, or comments from influential investors can sway market sentiment and contribute to price declines.

Market Cycles and Timing

Bitcoin’s Four-Year Cycle

Bitcoin tends to move in four-year cycles, closely tied to the halving events. While halvings do often lead to bull runs, these are typically preceded by periods of consolidation or even bear markets, as the market digests the impact of the halving.

Timing Matters

The timing of the halving in relation to the broader market cycle is crucial. If a halving occurs near the peak of a bull market, the subsequent price action may involve a sharp correction, as the market corrects from overbought conditions.

Miner Behavior Post-Halving

Reduced Miner Revenue

Halving events cut the block reward in half, which directly impacts miners’ revenue. If the price of Bitcoin does not increase sufficiently to offset the reduced rewards, miners may struggle to maintain profitability.

Selling Pressure from Miners

To cover operational costs, miners may be forced to sell more of their Bitcoin holdings post-halving, especially if prices are stagnant or declining. This selling pressure can contribute to downward price movements.

The Impact of Network Effects and Adoption

Slower Adoption Post-Halving

The anticipation of a halving often brings new investors into the market, but adoption can slow down post-halving, especially if prices are not rising as expected. This can lead to reduced buying pressure and contribute to price declines.

Network Congestion and Fees

Halvings can lead to increased activity on the Bitcoin network, driving up transaction fees and causing congestion. If the network becomes too expensive or slow to use, it can deter new users and investors, impacting demand and price.

The Role of Macroeconomic Factors

Global Economic Conditions

Bitcoin does not exist in a vacuum. Global economic conditions, such as interest rates, inflation, and geopolitical events, can significantly impact Bitcoin’s price. A halving event coinciding with a global economic downturn could lead to decreased demand and price declines.

Regulatory Changes

Regulatory developments can also influence Bitcoin’s price post-halving. For instance, new regulations or crackdowns on crypto in key markets can dampen investor enthusiasm and lead to price corrections.

Comparing Past Halving Cycles: A Historical Perspective

The 2012 Halving

The first halving in 2012 saw Bitcoin’s price rise steadily over the following year, culminating in a major bull run. However, the initial post-halving period was marked by volatility and corrections, with prices dipping before the eventual surge.

| Date | 28 November 2012 |

| Block number | 210,000 |

| Block reward, BTC | 25 |

| BTC created per day | 3600 |

| BTC price at the start | $12 |

| BTC price 100 days later | $42 |

| BTC price 1 year later | $964 |

The 2016 Halving

In 2016, Bitcoin’s price experienced a similar pattern. After the halving, there was a period of consolidation and a modest dip before the price began its meteoric rise in 2017. The initial decline was likely due to the factors we’ve discussed—profit-taking, miner behavior, and market sentiment.

| Date | 9 July 2016 |

| Block number | 420,000 |

| Block reward, BTC | 12.50 |

| BTC created per day | 1,800 |

| BTC price at the start | $663 |

| BTC price 100 days later | $609 |

| BTC price 1 year later | $2550 |

The 2020 Halving

The 2020 halving occurred during a unique time, with the COVID-19 pandemic influencing global markets. After the halving, Bitcoin experienced a short-term dip before embarking on a historic bull run. The initial decline was short-lived, but it still highlighted the uncertainty and volatility that can follow a halving event.

| Date | 11 May 2020 |

| Block number | 630,000 |

| Block reward, BTC | 6.25 |

| BTC created per day | 900 |

| BTC price at the start | $8740 |

| BTC price 100 days later | $11,950 |

| BTC price 1 year later | $58,250 |

The Psychology of Market Participants

Behavioral Finance: The Psychology Behind Price Movements

The psychology of market participants plays a significant role in post-halving price movements. The fear of missing out (FOMO) can drive prices up before a halving, while fear of loss can drive prices down afterward.

Cognitive Biases and Market Reactions

Investors often fall prey to cognitive biases, such as overconfidence and herd behavior. After a halving, if prices don’t rise as expected, these biases can lead to irrational selling, exacerbating price declines.

Long-Term Perspective: The Bigger Picture

Bitcoin’s Fundamental Value

Despite short-term fluctuations, Bitcoin’s long-term value proposition remains strong. Halvings are part of the coin’s deflationary nature, and while they may lead to short-term volatility, they also help preserve Bitcoin’s scarcity, which is a key driver of its value.

Historical Returns

Historically, Bitcoin has delivered substantial returns over the long term, despite periods of post-halving declines. Investors who understand the market cycles and maintain a long-term perspective are often rewarded.

Strategies for Navigating Post-Halving Price Declines

Dollar-Cost Averaging (DCA)

One effective strategy for mitigating the impact of post-halving declines is dollar-cost averaging (DCA). By regularly investing a fixed amount regardless of price, you can reduce the impact of volatility and build a position over time.

HODLing Through the Volatility

For long-term investors, holding onto Bitcoin through periods of volatility is often the best course of action. The historical data supports the idea that Bitcoin’s price tends to recover and reach new highs over time.

Diversification

Diversifying your crypto portfolio can help manage risk during post-halving periods. Investing in a mix of cryptocurrencies, as well as traditional assets like stocks or bonds, can provide a buffer against market downturns.

Conclusion: The Future of Bitcoin Post-Halving

Expecting the Unexpected

While Bitcoin halvings are often followed by price surges, it’s crucial to expect the unexpected. Short-term declines are not uncommon, and understanding the factors behind them can help you make informed decisions.

Staying Informed and Adaptable

The key to navigating post-halving price movements is staying informed and adaptable. By understanding the market dynamics, recognizing the role of sentiment, and adopting sound investment strategies, you can position yourself for success, regardless of short-term fluctuations.

The Long-Term Vision

Ultimately, the long-term vision for Bitcoin remains intact. As adoption continues to grow and the fundamentals of the network strengthen, the potential for future gains remains significant. By maintaining a long-term perspective and navigating the short-term volatility with confidence, you can make the most of Bitcoin’s unique market dynamics.

In the ever-evolving world of cryptocurrency, understanding the intricacies of events like Bitcoin halving is crucial. While post-halving declines can be disconcerting, they are a natural part of the market cycle. By leveraging historical insights, market psychology, and sound investment strategies, you can navigate these periods effectively and position yourself for long-term success in the crypto space.